Karnataka bank is an old-generation private sector bank. It is the twelfth largest private sector bank in India. It is an Indian ‘A‘ class scheduled commercial bank. Karnataka Bank was founded in February 1924 and is headquartered in Mangaluru, Karnataka. It facilitates not only banking services but also financial services as well and it has over eight hundred branches across the nation.

Reasons For Closing An Account In Karnataka Bank

A bank account provides endless opportunities to its holder. Still, an account holder may find it necessary to shut down his bank account due to any reason. A few reasons for closing a bank account in the Karnataka bank are listed below:

- Transfer of the account holder to some other city, state, or country.

- High account maintenance charges.

- High charges for financial transactions.

- Having multiple accounts.

- Lower interest rates or a reduction in the current interest rates.

- Inadequate online services by the bank.

- Poor customer care service of the bank, etc.

The reasons mentioned above can be one of the several factors behind an account holder deciding to shut down his bank account in Karnataka bank.

Steps to Close An Account In Karnataka Bank

Closing a bank account in the Karnataka bank is not a tedious task. With the help of the following steps, an account holder can easily close his bank account in the Karnataka bank.

But before closing the bank account, the account holder must make sure to leave only the minimum balance required for the maintenance of the account and withdraw all the excess funds.

The steps to be followed to close the Karnataka Bank account are:

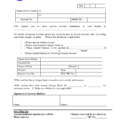

Step 1: Firstly, the account holder may download the account closure form online from the legal website of the Karnataka bank. Then, he must get the form printed in the form of a hard copy.

If the account holder is unable to download the form online, then he can also visit the nearest Karnataka Bank branch and get the physical copy of the form from the bank itself.

Step 2: After generating the form, the account holder must duly fill in his required details as well. The personal details required to be filled up in the form include the account number of the bank to be closed, the name of the account holder, the mobile number of the account holder, the signature of the authorized signatory of the bank account, etc.

Step 3: After entering all the details correctly, the account holder must sign in the space provided in the form. He must make sure that his signature matches the one which is already available in the records of the Karnataka bank. In the case of the joint account holders, all the joint holders need to sign the bank account closure form.

Step 4: After filling the form completely and wisely, the account holder must check it thoroughly. Once assured, he must hand over the filled form to the branch manager.

Step 5:Apart from the Karnataka bank account closure form, the account holder must also submit his self-attested KYC documents such as his PAN and proof of address. The PAN serves as the proof of identification of the account holder.

Step 6:Along with the KYC documents, the account holder must also hand over his debit card, his passbook, and the balance cheque left to the branch manager. The account holder must also write an application letter to the branch manager of the Karnataka bank, stating the reason to close his account.

Step 7:After all the necessary documents are produced and submitted with the account closure form, the Karnataka Bank account closure application gets the final approval and is then forwarded for further processes.

Step 8: Then, the bank verifies all the documents of the account holder and if it passes the verification test then it allows the account holder to withdraw his available funds from the bank account as per the option mentioned in his bank account closure form. The withdrawal can be in the form of either, cash, DD/Cheque, or the transfer of the remaining balance to some other bank account.

Step 9: Once the Karnataka bank account is successfully closed, the bank sends a confirmation message to the account holder either through an SMS on their registered mobile number with the bank, or through an email on the registered email ID of the customer, with the bank.

By following the process discussed above, the Karnataka bank account holder can easily close his Karnataka bank current account, savings account, or even the fixed deposits account. In case of any confusion, one can reach out to the Karnataka Bank helpline service on 18004251444.

Karnataka Bank Account Closure Charges

| Account | Closure Charges |

|---|---|

| Savings Account with Cheque book | Account Closed within 1 year-Rs. 100

Account Closed at 1 year & after 1 |

| Saving account without Cheque book | Account Closed within 1 year- Rs. 200

Account Closed at 1 year & after 1 |

| Current Accounts | Account Closed within 1 year-Rs.500

Account Closed at 1 year & after 1 |

Conclusion

Karnataka bank provides the facility of opening an account in its branch through the online method. But it does not provide the facility to its account holders to close their bank accounts through the online mode yet. Hence, the account holder needs to visit the physical branch of the Karnataka bank if he wishes to shut down his bank account.

Though the procedure to close a bank account is easy, the account holder should take this decision wisely because once closed it is not easy to reopen the closed bank account. Still, if one wishes to close his bank account then he must clear all his loans against his bank account and must transfer all the excess funds to some other bank account.

He must only follow the legal procedures by visiting the bank branch himself and he must not fall prey to the claims of any third person who assures to help you close your bank account online.

Be the first to comment