Banks help in the smooth running of an economy keeping all the financial aspects in mind. They are also responsible for safely keeping our money and providing us with the then prevailing rate of interest. However, in rare circumstances, people opt for closure of the bank account and there can be a variety of reasons for the same.

Nowadays almost all the banks have started online operations too providing hassle-free service to their users without paying a visit to the branch. Similarly, Punjab and Sind bank also provides offline facility to their users for closing an account. However, there is no such facility available for closing the account online in this bank. Therefore, to finish the procedure the user must go to the bank and get the procedure done.

Procedure to Close Punjab And Sind Bank Account

Before proceeding with the closure of the bank account the user must clear all his dues or charges if any, with the bank. Following are the detailed steps to be followed for closing an account with Punjab and Sind bank:

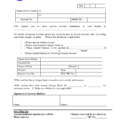

1. Filling up The Account Closure Form

To close an account in the said bank the user needs to fill a form. It can be downloaded from the official site of the bank or the user can visit the bank branch to obtain the form. After filling it carefully, the user needs to submit it to the officer in charge of the manager of the bank. In case the bank account is held by the joint owners then all of them must sign the form of account closure.

2. Attaching the KYC Documents

After the form is duly filled and submitted to the manager the holder must attach a copy of KYC documents too. KYC documents contain identity proof which may be a copy of a Driving license, Adhaar card, PAN card, etc. This identity proof also works as the user’s address proof and helps in the closure of the account. In some cases, the bank may ask the user to self attest the documents.

3. Surrender Passbook, Debit/Credit Card, And Balance Cheque Leaves

After attaching the required documents the user must also submit their passbook along with the Debit or Credit card issued by the bank and the balance cheque leaves if any to the manager. As soon as all the required documents are submitted to the bank the process of closing the bank account is taken into consideration.

4. Withdrawal Of Remaining Balance

After verification of all the required documents, the bank manager allows the user to withdraw the deposited sum of money from the bank. The user can opt for cash withdrawal or the bank can issue a cheque/DD in favour of the user to transfer the amount to some other bank account.

As soon as all the processes have been completed the user receives an SMS or email on the registered mobile number/ Email ID for the closure of the bank account.

| Services | Contact |

|---|---|

| Toll-free Number | 18004198300 |

| [email protected] |

Conclusion

Unfortunately, closing the bank account is not included in the services of the bank, and for this bank branch visit becomes necessary. Therefore, by following the above given simple steps one can close the Punjab and Sind bank account offline. In case of any doubts, there is an All India toll-Free number available to clear the grievances of the customers. This number is 1800-419-8300.

i request my close saving account