We know people want to close their bank account for two vital reasons the first one is if you are changing the job or city, and the second one is if your account is Demat. Central Bank of India is the best bank to provide the best quality services to its customers.

As you know every bank has online and digital facilities nowadays, Central Bank is not different from them. It has a net banking facility, a website where you can search for any details for your account, application, etc. Generally, when a person changes job, it won’t be in use for the future, so it will be good to close the account permanently.

Here, a minimum bank balance should be there to maintain the Central Bank account. Every bank has the rule to keep a minimum balance of Rs- 2500/- or 3000/-. If a person has multiple bank accounts, it will be problematic to maintain this massive amount on their bank accounts to avoid penalties.

Do not think to keep your bank account as usual, because in this way you may not be able to open any new account in the same branch, as one of your accounts with the same data is still available with the bank. If all things are clear, we will move on to the steps to be followed to close your Central Bank account.

Steps to Close the Central Bank of India account

No one wants to close their bank account in the Central Bank of India, as they have the best facilities over their customers. With this benefit, one person can control their bank account in Central Bank with no boundation. Still, if you want to close the Central Bank account, then here are the steps.

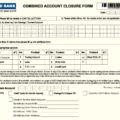

Step 1: Mind it, if you are trying to close your Central Bank account, you have to visit the home branch, as without visiting the home branch, you can not close the bank account in the Central Bank. Ask for the Central Bank account closure form from the bank’s staff.

Step 2: You have to go through the form thoroughly to check what are the requirements. Do not forget to carry the documents that you had used to open the Central Bank account. Put every single piece of data the form requires carefully. Make sure every data is genuine and understandable.

Step 3: D-link every card and policy if you have with this account you want to close. Because if you can not D-linked them, the payment can not be continuing. Do not do spelling mistakes, especially when it comes to name and address proof numbers. Do not overwrite at the same place twice. It can make the information shabby.

Important note: Submit your CBI checkbook, passbook, and ATM to close the bank account.

Step 4: It has to be mentioned that why you want to close your Central Bank account. It will help the bank to process the system faster. Carefully sign your name where it’s required. And do as you did at the time of opening the bank account. Because if it won’t match, the bank won’t work on your request.

Conclusion

Before submitting the form to the branch staff, go through it properly. Attach the KYC form that you made with this bank account in the Central Bank. Attach the Andhar card, Voter card, and Pan card photocopy with the bank account closure form.

Make sure you don’t have any balance left in your Central bank account. Write an application for transferring the left amount to your new bank account with proper details. Here, we write every detail you need to cover at the time of your Central Bank of India account closing. We are hoping this will be helpful to you. To know more information, please contact us.

I want to knoe Central bank account closing charges

Phone.py.chalu.ho.jata.lekin.namvar.central.beak.se.link.nji..hai