People usually like smart and fast work more than hard work. Thus, Yes bank comes with a smarter banking procedure for us. These days every bank has its official website, so the Yes bank and the website made the fast work faster. No one needs to visit the bank physically for every little banking task.

The Yes bank has been considered the Fastest Growing Bank by the prestigious media houses. The Yes Bank started in the year 2004 in Mumbai, India, and now it is the largest and most popular private sector bank in India. The Yes bank’s customers are getting extensive offers in corporate and retail banking both.

Some Reasons For The Yes Bank Account Closing

There are people who mostly have 2 or 3 bank accounts simultaneously, but it’s very hard to handle this. We all knew banks have the rule to keep a minimum balance in the account to keep it continue. Some banks have the system that if somehow some amount from the minimum balance is deducted, it will cause of fine from the bank authority.

So that one should always have the minimum account balance as it is. Still, there are students for whom it’s critical to maintain the balance as they don’t get into jobs or something like that to continue. Apart from this, there are other reasons also we are mentioning below.

- Low rate of interest levels for the customers.

- Imperfect customer services from a particular Yes Bank branch.

- Leaving a job or no need of the salary account.

- Changing the city or state where the bank account has been created to another.

- The money transaction rate is unpleasant.

These are the reasons people want to close their Yes Bank account. Other than this, there are so many different reasons can be for what a person can take the decision to close the Yes Bank account.

Steps to Close Yes Bank Account

We mentioned the reasons for bank account closing, and it is not that hard. Anyone can close their bank account themselves without any effort. As Yes Bank has not yet developed the facility to close the bank account online, you will need to choose to do it offline. The Yes Bank closing steps we are mentioning below.

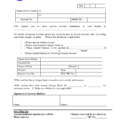

Step 1: Start by visiting the Yes Bank branch, and you have to request the account closure form from the branch staff. On the one hand, you can download the account closure form from Yes bank’s official website. You will get it in as per your convenient language.

Step 2: After downloading the form you have to print it in a hard copy, or else you can not submit it online. Or you can directly print it out from the website.

Step 3: Firstly, you have to take a good look at the form and keep this in your mind where what is needed. You will need your address proof, such as Adhaar or Pan card, to put it in the closure form. It will be in use for your KYC submission.

Step 4: You will need the bank account passbook and checkbook, whatever page has left in it. The Yes Bank staff maybe ask for it at the time of submission. Generally, the bank does not ask for the debit card still it would be equitable if you carry it with you.

Step 5: You will be asked why you choose to close your Yes Bank account, and there you need to write an application with all the detailed descriptions for the same. The application would be submitted to the respective branch manager.

Step 6: After all the procedures are done, you have to sign in the Yes Bank account closure form that must match the one in the bank computer data. In case the account is joint, both the members have to sign the form accordingly. After signing the filled-up form, make sure you nicely scrutinize it before submitting it to the branch manager.

Yes bank account closing charges

| Type of Account | Closure Charges |

|---|---|

| Saving Account | 30 days to After 1 year of account opening date – FreeOtherwise – Rs. 500 |

| Current Account | 31 Days to 12 Months of account opening date – 750 Rs. |

| NRE/NRO Account | Within 30 days – Free After 30 days to 1 year – 500 rs After 1 year – Free |

| Demat Account | NIL |

| Salary Account | Rs.500 after 30 days |

Conclusion

While submitting the Yes Bank account closure form, the bank branch manager will ask you to withdraw all your left amount in your account. If the closure form includes the facility mentioning how you want to withdraw the amount you have in your account, you can put it there. Or else, you can simply write an application for it stating the method you want for the withdrawal.

There are some procedures you have to maintain just the way it is. But, bank account closing is not as hard it seems. Once the form is submitted, the bank will start the verification to process the request. It will not take more than 3 to 4 banking days to complete the process.

Immediately after completing the request, the Yes Bank will notify you will a message on your registered mobile number. For any further assistance, you can call Yes Bank’s toll-free number available on its official website.

Be the first to comment